The Facts About Property Insurance Claims Uncovered

Table of ContentsThe 5-Minute Rule for Property Insurance ClaimsProperty Insurance Claims for BeginnersProperty Insurance Claims - QuestionsProperty Insurance Claims - TruthsAll about Property Insurance ClaimsA Biased View of Property Insurance Claims

There are a terrific lots of upset clients that figure out only after shedding their wedding ring that their fashion jewelry was not covered. So if you have any kind of costly jewelry or other pricey things that are easily shed or taken, make certain that you inform your insurance agent and also get ideal insurance coverage included in your policy.Additional Living Costs is your added living expense insurance coverage. This covers the expenses you might sustain if you are not able to live in your home for an amount of time as a result of it being damaged beyond habitability, if it was harmed and also is now unfinished, or if you are not allowed to go back to the location by government order (such as if there are wildfires in the area).

The smart Trick of Property Insurance Claims That Nobody is Talking About

This would be used if somebody dropped on your pathway and required medical interest, yet did not sue you.

This coverage doesn't relate to you or your member of the family or other individuals that live in your house, nevertheless; it is only for visitors. It likewise doesn't cover deliberate acts or anything pertaining to your home based business. Replacement Value vs. Actual Cash Worth "Replacement value" and "actual cash money value" are two distinctive methods insurance provider will certainly make use of to figure out the amount of the settlement to the insured: describes the reimbursement for reconstructing or replacing damaged items or structures in a manner comparable to their previous building.

If your couch is damaged in a house fire, they will certainly pay to buy a brand-new couch that is similar., on the various other hand, means the insurance provider will reimburse you for changing the couch, however will just pay as high as the sofa was worth at the time that it was destroyed.

The Greatest Guide To Property Insurance Claims

Standard or Named Hazards, If you desire to save money and also lug the financial danger of some losses on your own, consider a fundamental or called perils policy. This policy covers just those risks that are specifically specified. Broad, If these details a thorough policy expenses a lot more than you intend to pay and a basic or named hazards plan isn't ideal, a mid-priced concession is the wide insurance policy.

No Fuss, Some insurance companies supply standard or no fuss insurance coverage for residential or commercial properties that don't meet normal insurance policy criteria. If there are physical troubles with your residence that maintain it from satisfying the standards set by insurance companies, you may conserve cash over time by remedying these issues to qualify for better coverage.

Property Insurance Claims Fundamentals Explained

Along with the residence insurance coverage types defined above, insurance providers might utilize trademarked item names to define residence insurance plans.

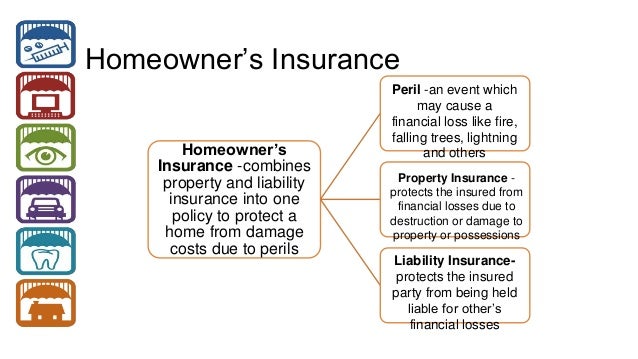

We turn currently to a more thorough discussion of the regulation associating with the 3 most typical kinds of insurance: residential or commercial property, responsibility, and life insurance policy. Home Insurance coverage It is often claimed that property is the foundation for a system of free market industrialism. If so, after that safeguarding building is click for source a required component of becoming part of that system, whether as an individual or as a company entity.

in the residential property. Insurable interest is a real as well as significant passion in specific home such that a loss to the guaranteed would certainly ensue if the residential or commercial property were damaged. You might not, as an example, obtain an insurance plan on a motel down the block with which you have no connection.

Everything about Property Insurance Claims

However if you assisted finance the motel and had a financial investment passion in it, you would certainly be permitted to place an insurance plan on it. This need of an insurable rate of interest comes from the public plan against wagering. If you might guarantee anything, you would in impact be betting on a mishap.

Any legal rate of interest suffices: a contractual right to purchase, as an example, or the right of property (a bailee might insure). This insurable passion has to exist both at the time you get the policy and also at the time the loss happens. Furthermore, coverage is restricted for the passion.

1 Subrogation SubrogationReplacement of someone for an additional who has a legal insurance claim or right. is the substitution of one individual for another in search of a legal case. When an insured is entitled to recoup under a policy for residential or commercial property damages, the insurer is stated to be subrogated to the insured's right to sue any type of third celebration that created the damages.

Some Known Questions About Property Insurance Claims.

The transfer of any rights in an agreement of insurance coverage. In home insurance, a difference is made between job of the coverage and also project of the profits.